Small businesses are an essential part of the American economy, and core to the financial security of our middle class. There are 56 million workers employed at firms with fewer than 50 employees, representing 45 percent of all private-sector jobs in the first quarter of 2022.[1] Young firms, which often start small with few employees, are a driving force in job creation. Moreover, closing the gap in small business ownership rates between Black and white households could narrow the gap in average net worth between these groups by up to $185,900 (22 percent), while closing the gap in ownership between Hispanic/Latino and white households could reduce these groups’ gap in net worth by $138,800 (17 percent). Together, these dynamics have made supporting small businesses a priority for the Biden Administration dragonpoker88.

RECENT STRENGTH IN SMALL BUSINESS APPLICATIONS

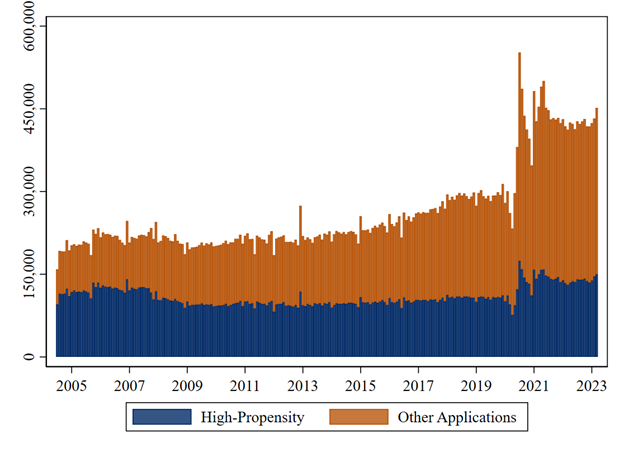

During the pandemic, there was considerable concern about the potentially disproportionate effects COVID-19 would have on small businesses. However, data show that small business growth has proved resilient, supported by effective and equitable implementation of the American Rescue Plan (ARP). 2021 saw the largest growth in new jobs among businesses with fewer than 50 employees on record, with over 3 million new jobs created across the country. The past two years have seen the two highest years of business applications on record (figure 1), as Americans applied to start nearly 10.5 million small businesses dragonpoker88.

Source: U.S. Census Business Formation Statistics and CEA calculations.

Note: Business applications refer to applications for an Employer Identification Number (EIN). High-propensity applications are those deemed likely to turn into a business with payroll.

As the economy transitions to stable, steady growth, new business formation and job creation will likely begin to slow from this exceptionally fast pace. While business applications remain elevated, the pace of job growth among small businesses slowed in 2022, compared to 2021.

INVEST IN AMERICA AND SMALL BUSINESSES

Recent laws core to the President’s Investing in America economic agenda—including the ARP, the Bipartisan Infrastructure Law (BIL), the CHIPS and Science Act (CHIPS), and the Inflation Reduction Act—can directly and indirectly provide opportunities for small and young firms. Indeed, written directly into the laws are a host of features designed explicitly to support small business. For example, the Inflation Reduction Act doubled the existing Research and Development tax credit for small businesses, and the CHIPS funding opportunity will partially evaluate applicants based on how they plan to create opportunities for minority-owned, veteran-owned, women-owned, and small businesses to participate in construction or the supply chain dragonpoker88.